The CIF (Customer Information File) number is a unique number assigned to each customer by the State Bank of India (SBI) for identification and internal record-keeping purposes. It contains a summary of all the account-related information of a customer, such as account details, contact information, and transaction history.

The CIF number is used by SBI to identify the customer and their account information, and it is required for various banking services such as account opening, transactions, loans, and online banking. In this article, we will explain the different ways to get your CIF number for an SBI account, whether you have your passbook or not.

How to Get CIF Number of SBI

Table of Contents

The CIF (Customer Information File) number is a unique number assigned to each customer by the bank for identification purposes. To get your CIF number for an SBI account, you can do the following:

- Visit the nearest SBI branch and ask for a CIF number. You will need to provide your account details and a valid government-issued ID.

- Contact SBI customer service through their toll-free number 1800 1234 or email and ask for your CIF number.

- Login to your SBI account through internet banking and check your account details, your CIF number should be available there.

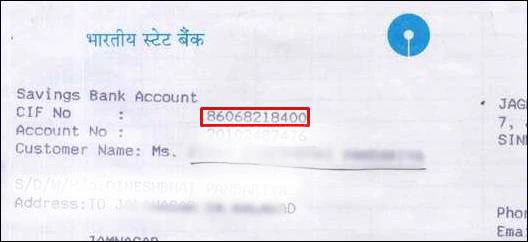

- Check your account passbook, your CIF number should be mentioned on it.

- In case you are not able to get it from above options, you can visit your home branch and ask for a duplicate passbook. CIF number will be mentioned on it.

How to get cif number of sbi through sms

It is possible to get your CIF number for an SBI account through SMS, but the process may vary depending on your specific bank branch or location. Here’s one way to do it:

Send an SMS to 567676 in the format “CIF ” (without quotes). For example, if your account number is 1234567890, the SMS would be “CIF 1234567890”.

After sending the SMS, you will receive an SMS from the bank containing your CIF number.

Please note that it is not guaranteed that the bank has this service available, you can also check their website or contact customer service to confirm if this service is available in your location.

How to get cif number of sbi with account number

You can get your CIF number for an SBI account with just your account number. Here are a few ways to do it:

- Visit the nearest SBI branch and ask for your CIF number. Provide your account number, and any other account-related documents you may have, such as a cancelled cheque or a statement.

- Contact SBI customer service through their toll-free number or email and ask for your CIF number. Provide them with your account number and any other required identification.

- Login to your SBI account through internet banking, your CIF number should be available under account details.

- Send an SMS to 567676 in the format “CIF ” (without quotes). For example, if your account number is 1234567890, the SMS would be “CIF 1234567890”. After sending the SMS, you will receive an SMS from the bank containing your CIF number.

Please note that it is not guaranteed that the bank has all this service available, you can also check their website or contact customer service to confirm if this service is available in your location.

How to get cif number of sbi without passbook

It is possible to get your CIF number for an SBI account without a passbook, but you will need to provide other forms of identification or proof of account ownership. Here are a few ways to do it:

- Visit the nearest SBI branch and ask for your CIF number. You will need to provide a valid government-issued ID, such as a passport, voter ID, or PAN card, as well as any other account-related documents you may have, such as a canceled cheque or a statement.

- Contact SBI customer service through their toll-free number or email and ask for your CIF number. You will need to provide them with your account details and a valid government-issued ID.

- Login to your SBI account through internet banking and check your account details, your CIF number should be available there.

- If you don’t have any account related document, you can visit your home branch and ask for a duplicate passbook. CIF number will be mentioned on it.

It’s always best to check with the bank about the specific requirements for obtaining your CIF number without a passbook, as the process may vary depending on your location or branch.

Sbi cif number online search

It is possible to search for your CIF number for an SBI account online, but the process may vary depending on your specific bank branch or location. Here’s one way to do it:

- Login to your SBI account through internet banking, your CIF number should be available under account details.

- Another way to check is by visiting the official website of SBI, and look for the option of “CIF number Enquiry” or “CIF Enquiry” under the “Accounts” section.

- Once you find it, enter your account number, and any other information required, and then submit the form.

- Your CIF number will be displayed on the screen.

Please note that, if you don’t have internet banking activated, you will need to visit the branch and complete the registration process and then you will be able to check CIF number online.

CIF Number on cheque book sbi

The CIF (Customer Information File) number is a unique number assigned to each customer by the bank for identification purposes. The CIF number is typically used for account identification and internal bank purposes.

In SBI, the CIF number is usually printed on the cheque book as well as in the passbook. You can find it on the first page of the cheque book, usually at the top right corner or on the bottom of the page. If you are unable to find it on the first page, you may check other pages of the cheque book.

It’s always best to check with the bank about the specific location of the CIF number, as the process may vary depending on your location or branch.

How to get cif number of sbi through yono

You can get your CIF number for an SBI account through YONO, SBI’s digital banking platform. Here’s the process:

- Download the YONO app from the App Store or Google Play and install it on your device.

- Open the app and register for an account using your mobile number.

- Login to your account and navigate to the “Accounts” section.

- Select the account for which you need the CIF number and you will find the CIF number in account details.

- Alternatively, you can also find your CIF number under the “Accounts” section, by selecting “Account Details”.

Please note that if you are not yet registered for YONO, you will need to visit the branch and complete the registration process.

What is cif number

CIF stands for “Customer Information File”. It is a unique number assigned to each customer by a bank for identification and internal record-keeping purposes. The CIF number contains a summary of all the account-related information of a customer, such as account details, contact information, and transaction history.

The CIF number is used by the bank to identify the customer and their account information. It is also used for various purposes such as account opening, transactions, loans, and other banking services. This number is usually required when you want to access your account information online, or when you want to link your account to other services such as mobile banking or internet banking.

CIF number is a confidential number and should be kept safe and should not be shared with anyone. Banks usually provide this number in the passbook, cheque book or account statement, but also it can be obtained by contacting the bank’s customer service or visiting a branch.

Uses of CIF number

The CIF (Customer Information File) number is a unique number assigned to each customer by a bank for identification and internal record-keeping purposes. The CIF number contains a summary of all the account-related information of a customer, such as account details, contact information, and transaction history. Here are some of the uses of CIF number:

- Account Identification: The CIF number is used by the bank to identify the customer and their account information. It is required for account opening, transactions, loans, and other banking services.

- Online banking: CIF number is usually required when you want to access your account information online, or when you want to link your account to other services such as mobile banking or internet banking.

- Credit Score: Banks use CIF number to check the credit history of a customer.

- Communication: Banks use CIF number to communicate with the customer, which includes sending account statements, alerts, and other important information.

- KYC (Know Your Customer): Banks use CIF number as part of their KYC process to ensure that they are doing business with legitimate customers.

- Transactions: CIF number is used to record and track all transactions made by the customer.

- Loans: Banks use CIF number to check the creditworthiness of a customer when applying for a loan.

It’s important to note that the bank uses CIF number for internal purposes and it is not a public number that should be shared with anyone, it should be kept safe and confidential.

ALSO READ:

- How to Check SBI Account Balance

- How to Generate SBI ATM Pin

- How to Activate Your SBI Debit Card

- How to Block Your SBI ATM Card

- How to Open SBI Account Online

- How To Close SBI Credit Card

- How To Change Mobile Number in SBI

- How To Check SBI Bank Balance

- How to Open PPF Account in SBI

- How to Get SBI Bank Statement

- How to Apply for ATM Card in SBI

- How to Download SBI Bank Statement

FAQ: About how to get cif number of sbi

Q: What is a CIF number?

A: CIF stands for “Customer Information File”. It is a unique number assigned to each customer by SBI for identification and internal record-keeping purposes.

Q: Why do I need a CIF number?

A: The CIF number is used by SBI to identify the customer and their account information. It is also used for various purposes such as account opening, transactions, loans, and other banking services.

Q: How do I get my CIF number for my SBI account?

A: You can get your CIF number for your SBI account by visiting the nearest SBI branch, contacting SBI customer service through their toll-free number or email, or by logging into your SBI account through internet banking.

Q: Can I get my CIF number without my passbook?

A: Yes, you can get your CIF number without your passbook by visiting the nearest SBI branch, contacting SBI customer service through their toll-free number or email, or by logging into your SBI account through internet banking and providing your account number.

Q: Can I get my CIF number through SMS?

A: Yes, you can get your CIF number through SMS by sending an SMS to 567676 in the format “CIF ” (without quotes). For example, if your account number is 1234567890, the SMS would be “CIF 1234567890”.

Q: How do I find my CIF number on my cheque book?

A: You can find your CIF number on your cheque book usually on the first page or in the account details section.

Q: What should I do if I lose my CIF number?

A: If you lose your CIF number, you can contact SBI customer service through their toll-free number or email and ask for it to be reissued. You may need to provide identification to confirm your identity.